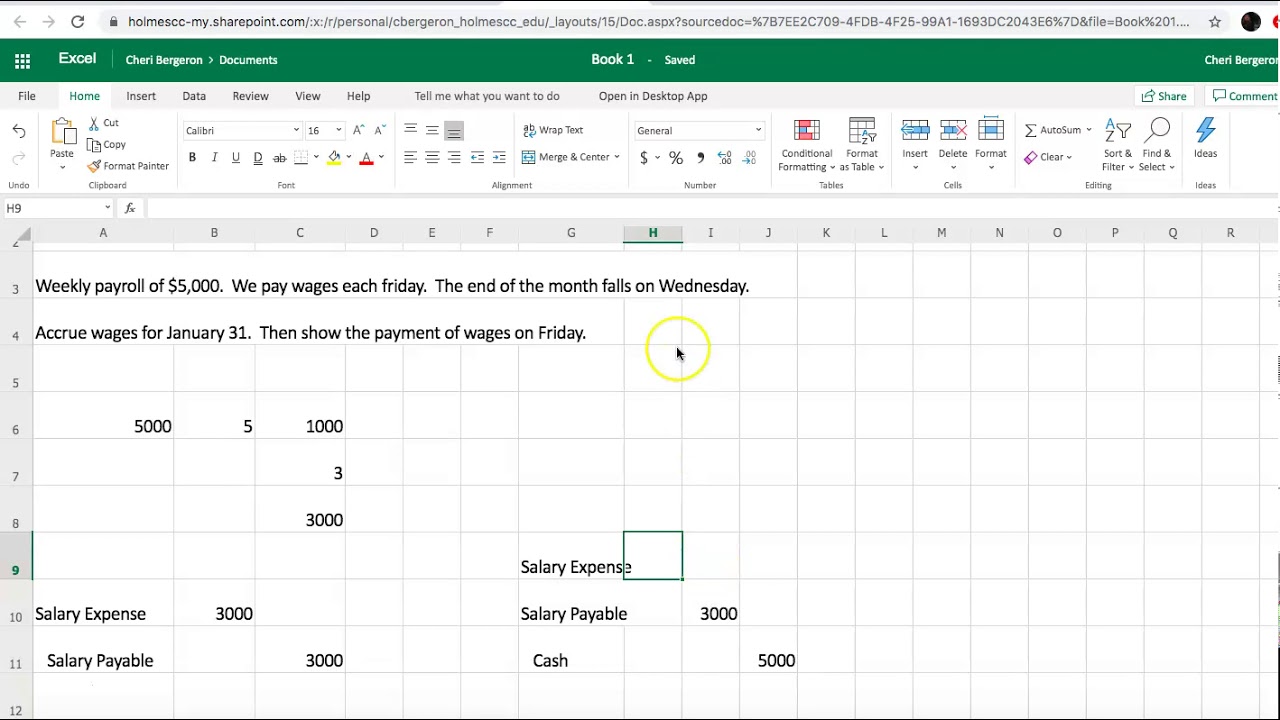

Accrued Salaries Journal Entry - Can make the accrued expense of journal entry for the five days of wages as below: Web discover how to calculate payroll accrual + journal entries. The basic principle behind accrual accounting is to record revenues and expenses regardless of payment. Web an accrued expense is an expense that has been incurred within an accounting period but not yet paid for. The first component involves identifying the specific period during which the salaries were earned but not paid. Web the journal entry to record accrued salaries involves debiting the salaries expense account and crediting the accrued salaries liability account. In the july 31 adjusting entry, the company abc ltd. Web accrued wages entry. Web this journal entry is made to eliminate the wages payable of $3,000 that company abc has recorded in the january 31 adjusting entry. For small businesses that use the accrual.

Accrued Salary Journal Entry YouTube

The company can make the accrued wages. Web the journal entry to record accrued salaries involves debiting the salaries expense account and crediting the accrued.

Accrued Salaries Double Entry Bookkeeping

Journal entries are rightly called the backbone of the modern accounting system as they are the first. Web this journal entry records $10,000 as an.

Payroll Journal Entry Example Explanation My Accounting Course

At the end of each month, the amount that has been earned during the month must be reported on the. Likewise, as the expense has.

Accrued revenue how to record it in 2023 QuickBooks

Likewise, as the expense has already incurred, the company needs to properly make journal entry for accrued salaries at the end of. Web the journal.

10 Payroll Journal Entry Template Template Guru

An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it.

NonProfit And Payroll Accounting Examples of Payroll Journal Entries

Web discover how to calculate payroll accrual + journal entries. In accounting, accrued salaries are the amount that the company owes to its employees for.

Accruals and Prepayments Journal Entries HeathldDunn

Likewise, as the expense has already incurred, the company needs to properly make journal entry for accrued salaries at the end of. When recording unpaid.

How to Adjust Journal Entry for Unpaid Salaries

In the july 31 adjusting entry, the company abc ltd. In accounting, accrued salaries are the amount that the company owes to its employees for.

Reversing Entries

For small businesses that use the accrual. Web no journal entry is made at the beginning of june when the job is started. At the.

Journal Entries Are Rightly Called The Backbone Of The Modern Accounting System As They Are The First.

Web discover how to calculate payroll accrual + journal entries. Web the accrued salaries entry is a debit to the compensation (or salaries) expense account, and a credit to the accrued wages (or salaries) account. Following accrual and prepayment adjustments are required for 2014. There are all kinds of accrued expenses your business might be.

Explanation Example Journal Entries To Record Accrued Expenses Accrued Expenses Faqs.

Web key components of unpaid salary entries. Can make the accrued expense of journal entry for the five days of wages as below: Web what is an adjusting journal entry? The first component involves identifying the specific period during which the salaries were earned but not paid.

An Adjusting Journal Entry Is Usually Made At The End Of An Accounting Period To Recognize An Income Or Expense In The Period That It Is.

Though salaries of $70,000 were paid on 4 july 2014, they related to services provided by employees in june 2014. Web accrual accounting is an accounting method that records revenues and expenses when they are earned or incurred, regardless of when the cash transactions. Web this journal entry is made to eliminate the wages payable of $3,000 that company abc has recorded in the january 31 adjusting entry. When recording unpaid salaries, several elements must be meticulously documented to ensure the accuracy and integrity of financial statements.

Web The Initial Journal Entry Of An Accrued Wage Is A “Debit” To The Employee Payroll Account, With The Coinciding Adjustment Being A “Credit” Entry To The Accrued.

Web no journal entry is made at the beginning of june when the job is started. Web the journal entry for payroll accruals involves debiting the salaries expense journal entry and crediting accrued payroll liabilities journal entries. Accrued salaries are expenses that have been incurred, but not yet paid for,. At the end of each month, the amount that has been earned during the month must be reported on the.