Accrued Interest Journal Entry - Interest is the fee charged for use of money over a specific time period. Updated on february 23, 2023. Written by true tamplin, bsc, cepf®. You can make money off of accrued interest when it comes to bonds,. Web understand the essentials of accrued interest, from calculations and journal entries to its impact on financial statements and tax implications. Web accrued interest is the accumulation of interest that a borrower owes for “time value” on a loan from the beginning of the term. The amount will depend on the deposit amount and interest rate. Web calculate and record accrued interest. Web learn how to create common journal entries for accrued interest, including adjusting entries and delayed bond issues sold at par value. Since the payment of accrued.

Who Pays For The Loan Origination Course

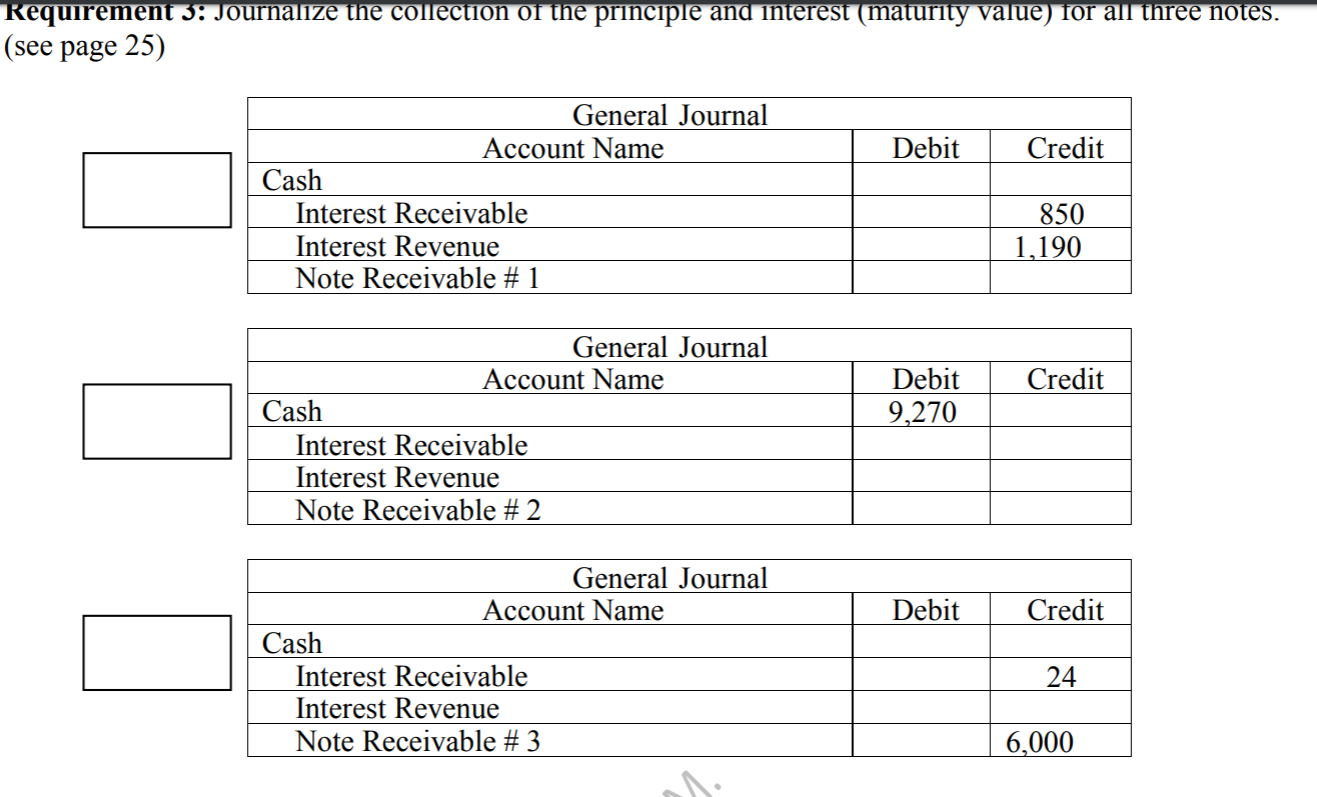

Accrued interest is the interest that incurs due to a loan that creditor issues to the borrowers, but it is not yet paid or received.

What is Accrued Interest? Formula + Loan Calculator

Web accrued interest journal entry. Learn how to record accrued interest as an expense or revenue in accounting, depending on whether you are a borrower.

Aufgelaufene Gehälter Steve Walton's

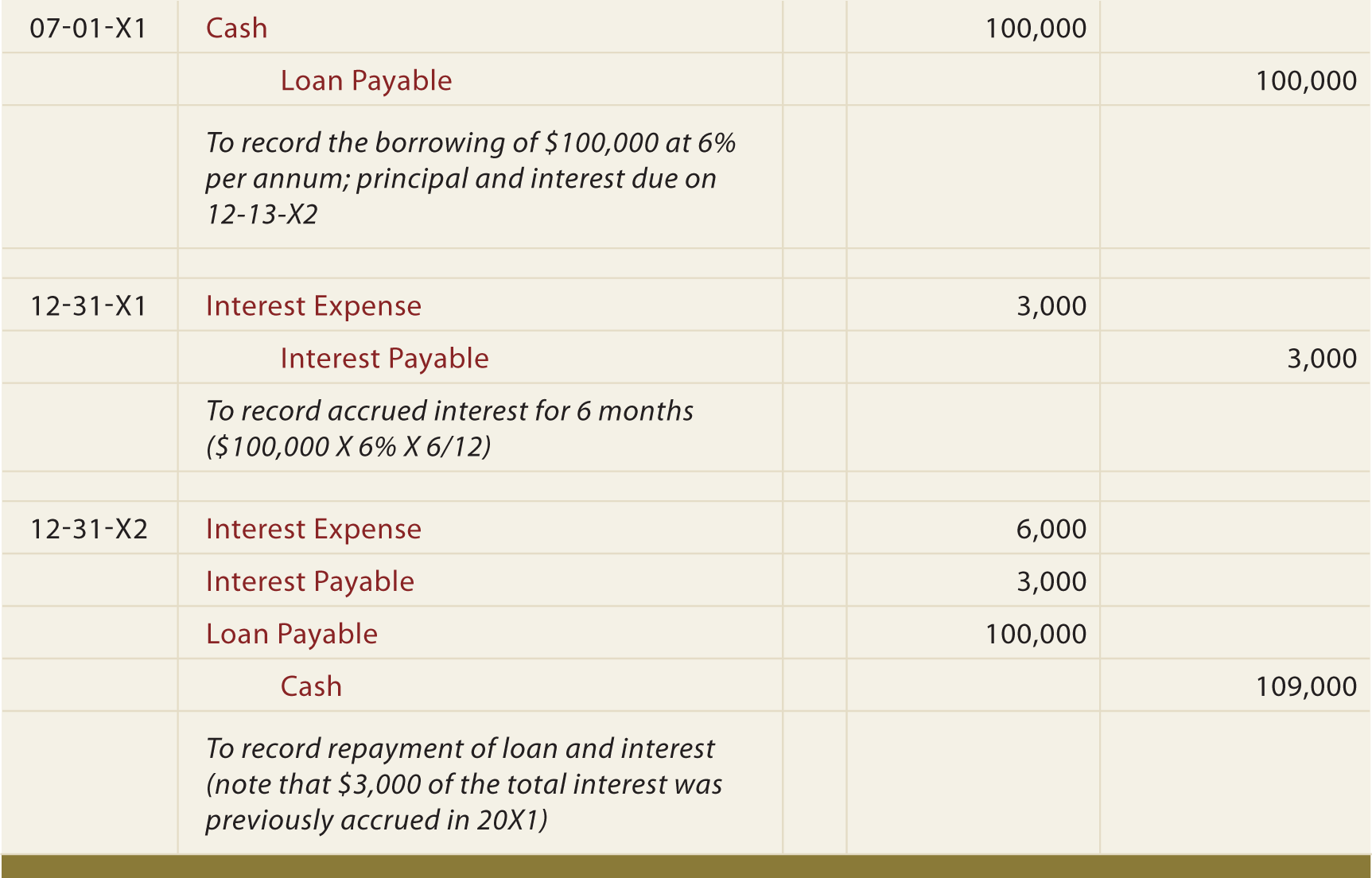

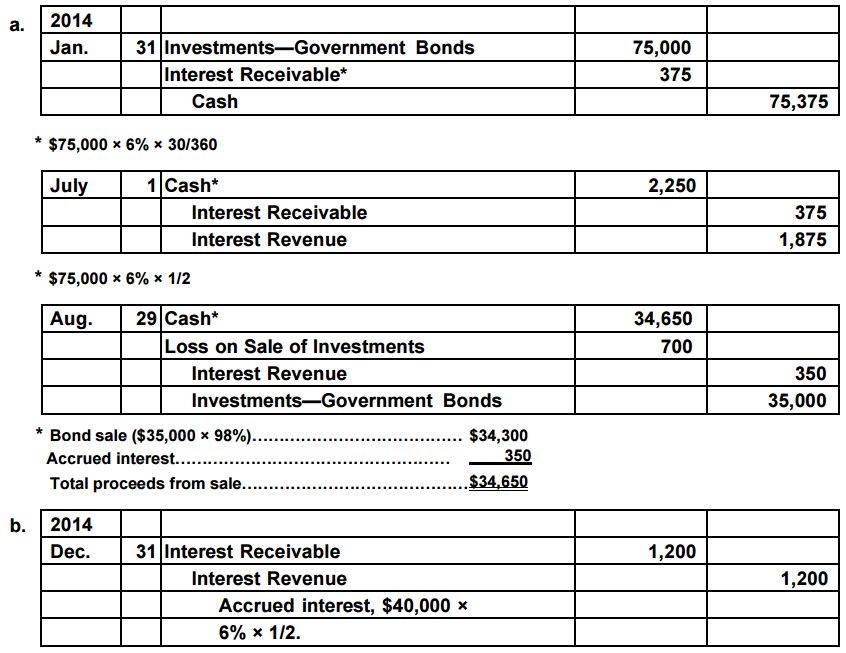

For example, if an individual. Web the entry consists of interest income or interest expense on the income statement, and a receivable or payable account.

[Solved] Help due tonight Interest Payable Accrual Adjustments (pages

The process for recording accrued interest may vary depending on your status, such as whether you're a borrower or lender. Accruals are adjusting entries that.

LongTerm Notes

Interest is the fee charged for use of money over a specific time period. To the maker of the note, or borrower, interest is an.

Notes Receivable with year end accrual of interest YouTube

Web accrued interest is the accumulation of interest that a borrower owes for “time value” on a loan from the beginning of the term. Since.

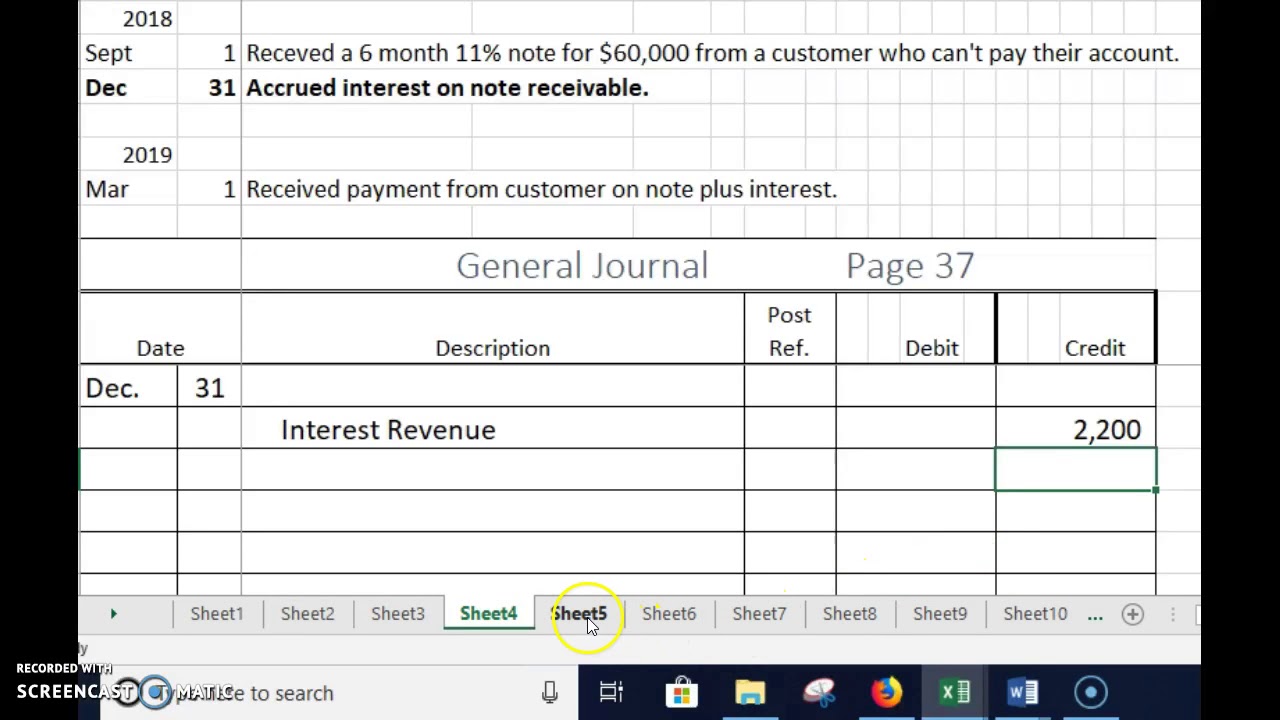

Outline page 28, the journal entry for the collection

To the maker of the note, or borrower, interest is an expense; Web how to record accrued interest. Since the payment of accrued. Web accrued.

Self Study Notes The Adjusting Process And Related Entries

Web learn how to create common journal entries for accrued interest, including adjusting entries and delayed bond issues sold at par value. Since the payment.

Accruals Definition India Dictionary

Web accrued interest is posted as an adjustment journal entry at the end of an accounting period and reversed on the first day of the.

Learn How To Record Accrued Interest As An Expense Or Revenue In Accounting, Depending On Whether You Are A Borrower Or A Lender.

Web learn how to create common journal entries for accrued interest, including adjusting entries and delayed bond issues sold at par value. Since the payment of accrued. Dr expense account (p&l) cr accruals (balance sheet) the debit side of this journal increases the expense account. Updated on february 23, 2023.

See How To Make Adjusti…

Web understand the essentials of accrued interest, from calculations and journal entries to its impact on financial statements and tax implications. Written by true tamplin, bsc, cepf®. Web how to record accrued interest. If this journal entry is not made, our total expenses on the income.

Accruals Are Adjusting Entries That Record Transactions In Progress That Otherwise Would Not Be Recorded Because They Are.

Web this journal entry of the $2,500 accrued interest is necessary at the end of our accounting period of 2021. The amount will depend on the deposit amount and interest rate. Web accrued interest income journal entry. Web the entry consists of interest income or interest expense on the income statement, and a receivable or payable account on the balance sheet.

Web An Accrued Interest Journal Entry Is A Method Of Recording The Amount Of Interest On A Loan That Has Already Occurred But Is Yet To Be Paid By The Borrower And Yet.

Web accrued interest is the accumulation of interest that a borrower owes for “time value” on a loan from the beginning of the term. Web accrued interest journal entry. Web accrued interest is posted as an adjustment journal entry at the end of an accounting period and reversed on the first day of the next period. To the maker of the note, or borrower, interest is an expense;