Accrued Expenses Journal Entry Example - Web common examples of accrued expenses are salaries, wages, bonuses, and commissions owed to employees, utilities consumed but not yet billed, and taxes incurred but not yet paid. A few examples of the accrued expenses that your company might need to track include: The expenditure account is debited here, and the accrued liabilities account is. Accounting for accrual of revenues involves the following journal entries: Wages or salaries incurred but payment not made yet. However, in this case, a payable and an expense are recorded instead of a receivable and revenue. An accrual is a record of revenue or expenses that have been earned or. Web the journal entry for accrued salary expense or salary payable is as follow: To help you further, let’s suppose a company pays its employees twice a month, with paychecks being issued on the final day of the pay period. As an example, a company could hire a consultant and receive their services before an actual cash payment is processed.

Accrued Expense Explained With Journal Entry and Adjusting Entry

Bonuses, salaries, or wages payable. At the end of period, accountants should make sure that they are properly recorded in the books of the company.

Accrued expenses journal entry and examples Financial

As an example, a company could hire a consultant and receive their services before an actual cash payment is processed. Wages are payments to employees.

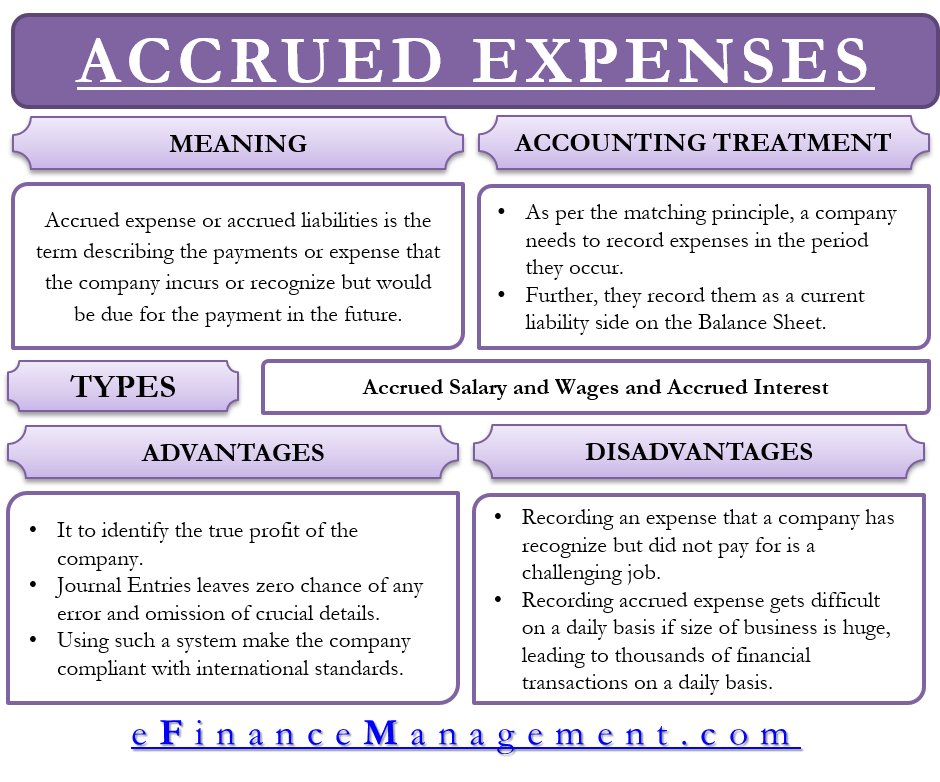

Accrued Expense Meaning, Accounting Treatment And More

Adjusting entries at the end of the each accounting period to debit accrued accounts receivable and credit revenue. As an example, a company could hire.

Accruals and Prepayments Journal Entries HeathldDunn

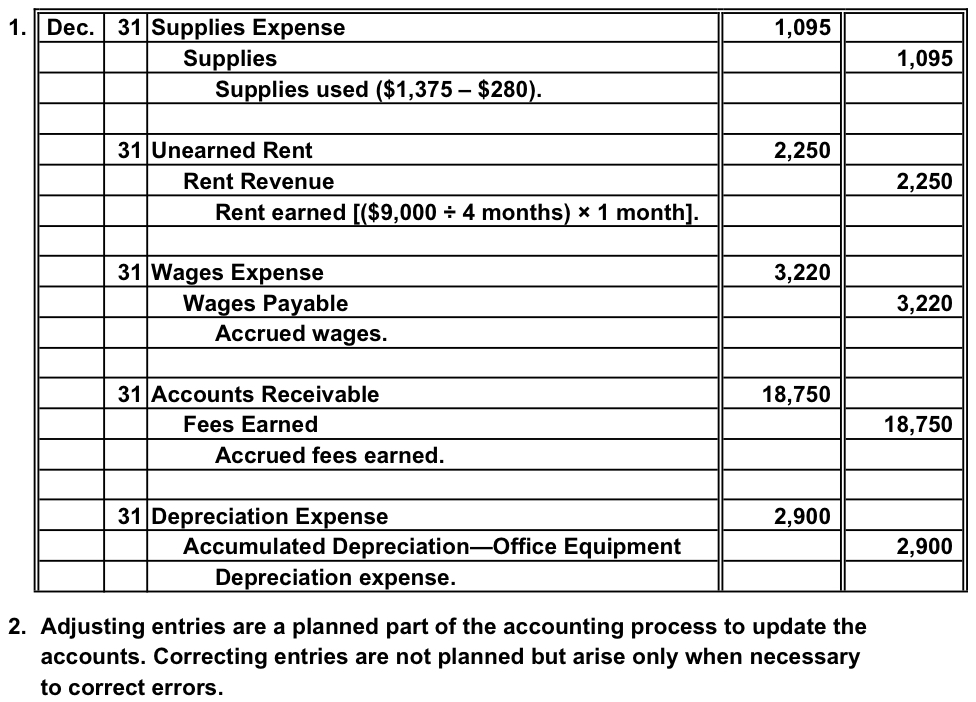

Adjusting journal entries are a feature of accrual accounting as a result of. Web accrued expense refers to an expense that the company has not.

Journal Entries and Trial Balance in Accounting Video & Lesson

Web an accrued expense journal entry is passed on recording the expenses incurred over one accounting period by the company but not paid actually in.

Accrual Accounting Examples Examples of Accrual Accounting

What is accrual basis of accounting? However, in this case, a payable and an expense are recorded instead of a receivable and revenue. Like accrued.

Accrued revenue how to record it in 2023 QuickBooks

Goods received and sold but supplier invoice not yet received. Web examples of accrued expenses are given below: Payments owed to contractors and vendors. Web.

Lasicamping Blog

The initial journal entry on the company’s books is as follows. Web accrued expense example. Payments owed to contractors and vendors. When a company accounts.

Basic Accounting for Business Your Questions, Answered

Goods received and sold but supplier invoice not yet received. Web accrued expense example. An adjusting journal entry is usually made at the end of.

You May Have Accrued Expenses From Various Sources.

Web accrued expense journal entry: The expenditure account is debited here, and the accrued liabilities account is. However, in this case, a payable and an expense are recorded instead of a receivable and revenue. Web accrued expense example.

Unused Vacation Or Sick Days.

Web common examples of accrued expenses are salaries, wages, bonuses, and commissions owed to employees, utilities consumed but not yet billed, and taxes incurred but not yet paid. Goods received and sold but supplier invoice not yet received. Wages are payments to employees for work they perform on an hourly basis. Your employees earn wages but are paid in arrears, which is in the following period (e.g., pay period in october with pay date in november).

Wages Or Salaries Incurred But Payment Not Made Yet.

Web the journal entry for accrued salary expense or salary payable is as follow: The initial journal entry on the company’s books is as follows. When a company accounts for expenses that it may pay off later, it may. For example, suppose that on 1 july 2019, dogget company borrowed $10,000 from a local bank.

How Accrual Basis Accounting Differs From Cash Basis Accounting.

Taxes incurred but no government invoice received yet. Web here are some common examples of accrued liabilities: What is accrual basis of accounting? If an accrued expense is incurred and recognized, the initial journal entry is as follows.