Accrued Expenses Example Journal Entries - If an accrued expense is incurred and recognized, the initial journal entry is as follows. Jen’s fashion boutique rents a small storefront in the local mall for $1,000 a month and usually incurs $200 a month in utility expenses. They are generally recorded as current liabilities since they generally get paid within a year from the date of incurring. Web the journal entry for accruals is as follows: Web journal entries to record accrued expenses. Assume that as of 31 march 20x9, abc co has not made the payment on salary expenses of 2 staff for a total of $10,000. Accrued expense is the expense that has already incurred during the period but has not been paid for yet. The accounting entry required to bring accrued expenses to books is: How do accruals work in accounting. Web a journal entry is a record of a business transaction.

Accrued expenses journal entry and examples Financial

The transaction is in progress, and the expense is building up (like a “tab”), but nothing has been written down yet. For example, a company.

Accrued revenue how to record it in 2023 QuickBooks

Jen’s electric bill is due on the 15th of every month. The company needs to make an adjusting entry at the end of january to.

Accrued Expenses Journal Entry How to Record Accrued Expenses With

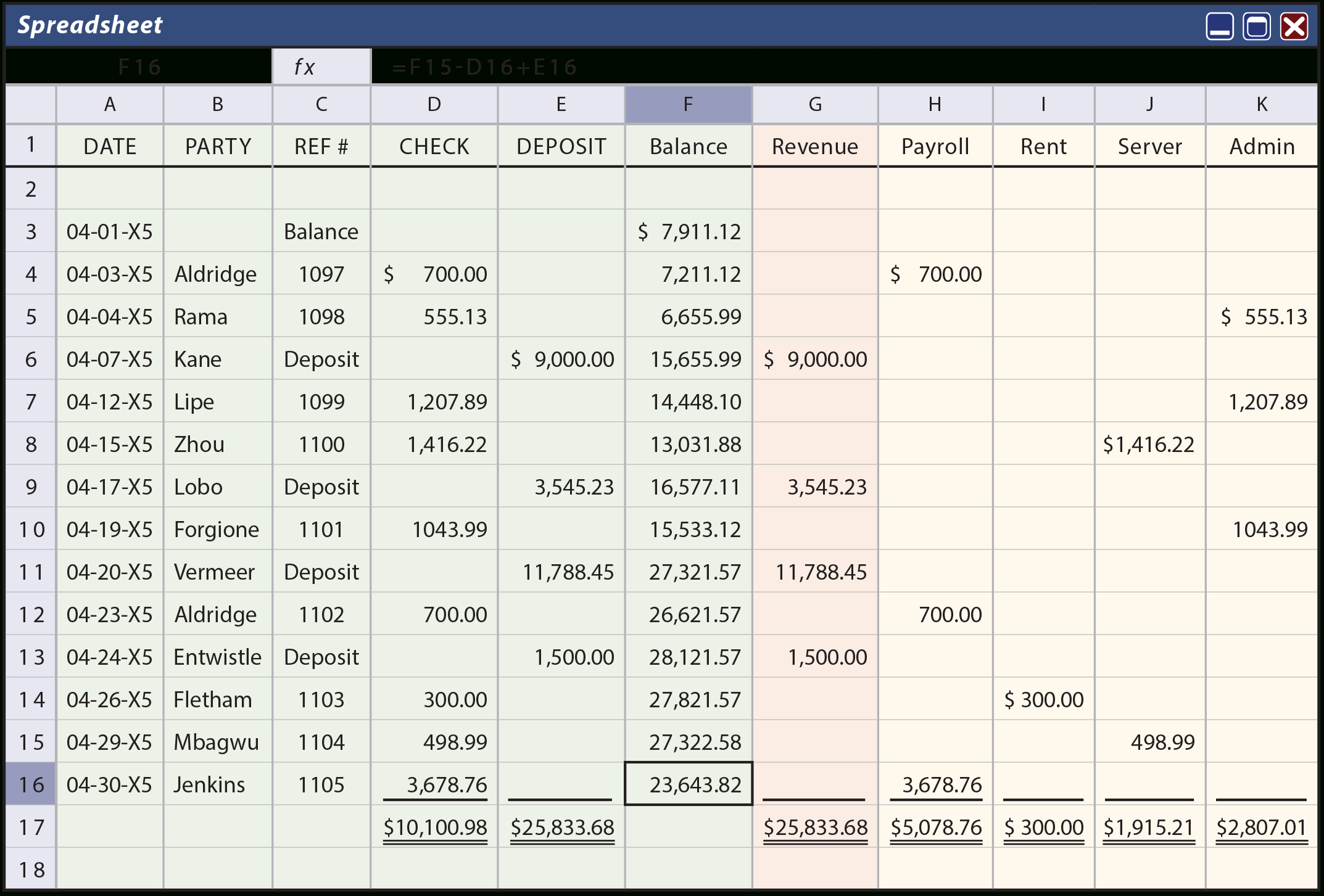

For businesses that are continually making financial transactions such as buying inventory, paying bills, and collecting revenue, this step will. Now, you can record the.

Lasicamping Blog

Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. Let's say that.

What are Accrued Expenses? Definition + Examples

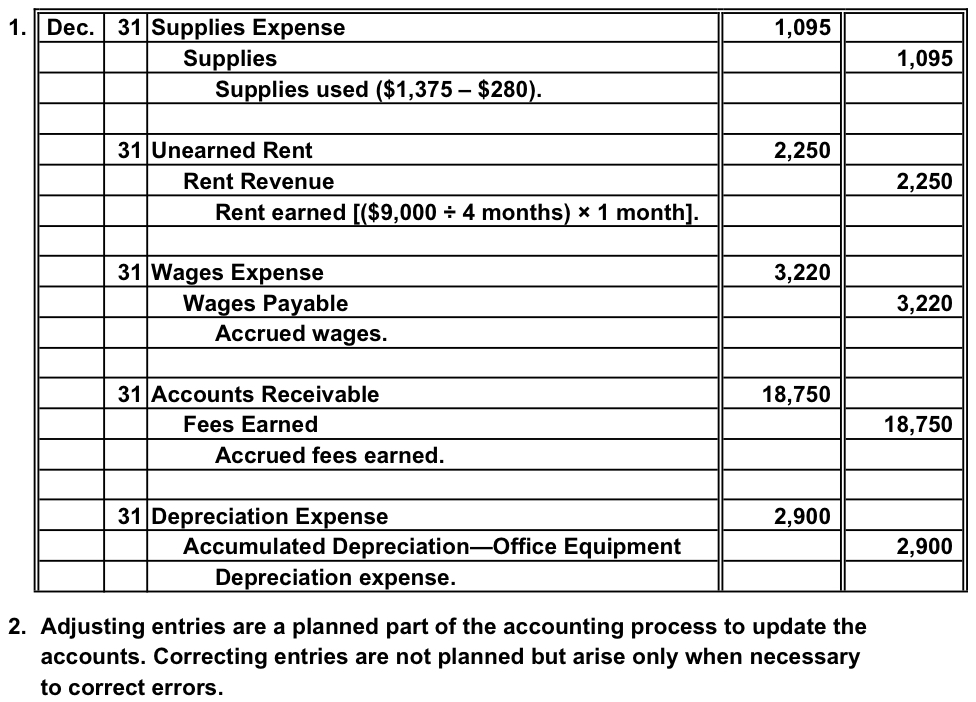

Accrued expenses require adjusting entries. An example of an accrued expense might include: Web typical accrued expenses include salaries, wages, goods, and services consumed but.

Accrued Expense Meaning, Accounting Treatment And More

They are generally recorded as current liabilities since they generally get paid within a year from the date of incurring. Adjusting journal entries are a.

Accruals and Prepayments Journal Entries HeathldDunn

An example of an accrued expense might include: The $1,000 debit shows that your total office supplies expenses increased by $1,000. Web a few examples.

Journal Entries Accounting

Journal entries for cash expenses. Web journal entries to record accrued expenses. Web the journal entry for accruals is as follows: Jen’s fashion boutique is.

Expense Accrual Spreadsheet Template —

When a company accounts for expenses that it may pay off later, it may record these liabilities as accrued expenses. Assume that as of 31.

Viron Company Entered Into A Rental Agreement To Use The Premises Of Don's Building.

Cost of future customer warranty payments, returns, or repairs. Dr expense account (p&l) cr accruals (balance sheet) the debit side of this journal increases the expense account balance (i.e. Accrued expenses require adjusting entries. When a company accounts for expenses that it may pay off later, it may record these liabilities as accrued expenses.

Web How To Enter Accruals In Journal Entries.

A journal entry for accrued expenses is an adjustment at the end of the year to document the expenses incurred during the current year but not paid until the following year. Let’s say a company estimates it used $1,500 of electricity for january, but the utility bill will not be received until february. The company needs to make an adjusting entry at the end of january to recognize the utility expense that has been incurred but not yet paid. Accrued expense is the expense that has already incurred during the period but has not been paid for yet.

Thus, Abc Co Shall Need To Record The Accrued Salary Expense As Part Of Its Adjusting Entries During The Closing.

For businesses that are continually making financial transactions such as buying inventory, paying bills, and collecting revenue, this step will. Web accrued expenses journal entry example. How accrual basis accounting differs from cash basis accounting. Accrued expenses are recognized on the books when they are incurred, not when they are paid.

And A Credit To Cash Or Bank Account.

Bonuses, salaries, or wages payable. Web journal entries to record the payment of expense on payment date involve debits to expense account and relevant accrued liability account; These adjustments are crucial for maintaining the accuracy and integrity of financial statements. Example on jul 1, 20x4, company a obtained a loan of $50,000 for five years at interest rate of 8% per annum from company b.